Toys R Us: Say Goodbye to an Era

For many, we grew up with Toys Я Us as the go to place to find that cool new toy, game, doll, action figure, Teddy Ruxpin, train set, learning toy, crayons, movie or even video games. Times are a changin’ folks and Toys R Us now finds itself way less than one Barbie away from permanent closure. Let’s explore.

For many, we grew up with Toys Я Us as the go to place to find that cool new toy, game, doll, action figure, Teddy Ruxpin, train set, learning toy, crayons, movie or even video games. Times are a changin’ folks and Toys R Us now finds itself way less than one Barbie away from permanent closure. Let’s explore.

Update from the News Desk — 2018-03-14

Toys R Us headquarters has apparently informed all US and UK employees on Wednesday, March 14th that all US and UK locations would be closed, a move that would lose 33,000 jobs. This would be one of the biggest retailer liquidations. CEO David Brandon intended to file paperwork to begin the liquidation proceedings on Wednesday.

From small to BIG to defunct

In the 70s, I remember toy stores primarily consisting of smaller retailers in malls, usually carrying Lincoln logs, wooden toys or learning toys. While I didn’t mind visiting these places, they felt more like a library than a toy store. They also didn’t carry much of the things that I liked. It wouldn’t be until sometime the mid-70s when a Toy R Us opened near my house. That’s when toy shopping all changed, at least for me.

I’m sure my parents hated taking me to Toys R Us, just as so many parents do. For us kids, it was like a day at Disneyland: a gold mine, a treasure trove, a place of dreams. Unfortunately, the parents were having none of it… or at least, as little as they could walk out of the store carrying. Good on them, but that didn’t make Toys R Us any less magical to a 8-10 year old. We loved it, we loved going there and we especially loved it when we got to take something home with us.

Geoffrey

I was never a super big giraffe fan, but Geoffrey was a fun and charming mascot constantly pointing out cool new things in the store. I would come to see Geoffrey as cute mascot designed to help me find new stuff. Not always, but a good bit of the time. Sometimes he was just present, like Mickey Mouse. That Giraffe always made me smile because I knew that I was at that magical place, like Disneyland but local. Over the years, Geoffrey began being used less and less by TRU, but he’s still considered their mascot.

Every once in a while, Toys R Us would offer an enter-to-win a fill-your-cart shopping spree. I always wanted to win one of those as a child, but alas never did. To think what I would have filled my cart with. The mind boggles, if only because some of those toys are considered highly collectible today. Though, those toys most assuredly would not have remained closed in their packaging after making their way home.

Growing Up

As I grew into my 20s, got my own car and job, my relationship with Toys R Us changed. No longer was it that magical place, but it now had firmly become a store and I was a consumer. Still, it was a place to go to find that hot new toy that everyone’s talking about. It also became the place to find computers and video games. If I couldn’t find it at Target or Kmart or, later, Walmart, I could almost certainly find it at Toys R Us or Kaybee or Children’s Palace (competitors at the time) and to a much lesser degree FAO Schwarz. Toys R Us was always the first place to go, then the others as they were less reliable.

Dominoes

As the competitors fell over one at a time, first Children’s Palace in 90s, FAO Schwarz in early 00s, then in the middle 00’s, Kaybee Toys, Toys R Us was still standing and, in 2009 would acquire the FAO Schwarz brand, but would sell it off in 2014. It was (and currently is) the place to go to find all things toys. Unlike Target and Walmart that choose to stock limited toy items, Toys R Us (like the previous Children’s Palance and Kaybee) still carries aisle after aisle of wide ranging toys you can only find at Toys R Us. You simply can’t find this selection of toy items at a discount department store. This is why I always ended up at Toys R Us in search of fun, exciting new things.

The Mistakes

Throughout the later years, I’ve grown a love-hate relationship with the Toys R Us chain. Not only because I worked there for a short time while in my 20s, but also because the management does a lot of things that don’t make sense. For example, Babies R Us. For a time, Toys R Us stores devoted half of their space to baby goods. I don’t have a baby, so there’s no interest in that. Yet, Toys R Us decided to kill half of their store space to devote to these products. This meant, less space for toys, games and other items.

I understand that the management wanted to expand their selection into babyland, but it was a mistake to take away valuable Toys R Us aisle space to devote to all-things-baby. This, in my opinion, was one of the biggest mistakes the Toys R Us management foisted upon its stores. That was, until they finally spun Babies R Us into its own stores and gave it its own space.

Later, the management decided to do away with separate Babies R Us stores and chose to abut the two stores together for one seamless one-store experience. That was at least better than taking away shelf space from an already cramped toy store, but even that was unnecessary and, in my opinion, a mistake. They can be next to each other, but walled off and separate stores with separate stock and separate staff. I know why they did chose to hook them together. They did it so they could use one set of checkout lanes, one set of cashiers and one set of staff to stock both stores.

The X

At around the time that Babies R Us was coming into its own as a separate store chain, Toys R Us decided to change its shelving layout. Instead of the more logical long rows running from the front to the back of the store (with middle store aisle breaks) which made it easy to find everything, the store layout designer decided to change the aisles to be side to side and then create X shaped rows in the middle of the store. Not only were these rows much harder to navigate, the layout of the aisles were crippled as a result. This layout made finding things incredibly hard and it seemed like they had less shelf space.

Not only was everything now moved around haphazardly, it made finding what you’re looking for overly hard. Meaning, now you had to navigate the whole store looking at everything just to find that thing.

Maybe the designers thought this was a good idea? It wasn’t. This is the second mistake from Toys R Us management.

Overbuying and Stocking the Wrong Toys

I don’t know how many times I visited Toys R Us in the 90s only to find the same toys every time I visited, sometimes months apart. These we affectionately call peg warmers. This mistake continues to plague Toys R Us to this day. Not only did Toys R Us have incredible buying power way back when, they just didn’t use it to their advantage. Instead, they would continually overbuy on dud toys and not buy enough on the hot toys.

You can’t sell toys that you don’t have in stock. For example, Cabbage Patch kids. When that craze hit, they couldn’t keep them on the shelves. You’d think Toys R Us could have negotiated with the manufacturer and buy 10x the amount they originally bought… simply so they could fill the demand. Sure, there might be a drought while the manufacturer created more, but eventually they would have enough stock quickly to satisfy demand. Alas, they didn’t and the shelves remained bare until the toys were so cold you couldn’t even give them away. Too little, too late.

Further, Toys R Us needed to let the local managers order stock for their specific location to stock toys that are regionally hot. Not every toy sells the same in every store, yet Toys R Us felt the need to send cookie cutter stock out to every single store. If you walked into a Toys R Us in any state, you’d see identical stock. Each store manager needed to be given free reign to specifically order stock in sizes that made sense for amount of local demand they were seeing for a given toy item. If they couldn’t keep a specific skateboard stocked, then the manager should be able to order the proper amount to cover the local demand from their store. In fact, stores that couldn’t sell the item should have shuffled the stock over to stores where the demand was high. That’s smart inventory management. Nope.

Store managers should also be able to nix slow selling items from their shelves and replace it with hotter selling toys. Why continue to carry that obscure toy that you can’t even clearance out when you can sell 100x as many Tickle Me Elmos? Having great selection is fine as long as you’re not stocking 50 of an item you can’t even give away. Again, smart inventory management people. Stock them in small quantities, sure, but not in the quantities that each store was getting. Shuffle extra stock to other stores that have none. Remember, I worked there, I saw the stock amounts in the stock room.

Nope. Toys R Us continued to make this mistake year after year.

Over-expansion

Nearly every business thinks they should open as many stores as physically possible. But, you can’t do this when most of your stores are operating in the RED. Toys R Us was no exception. This chain continually felt the need to open new stores rather than trying to shore up their existing stores and get them each to an individually profitable status. If the management had stopped their expansion plans and, instead, focused their efforts on making each store profitable by the end of Q1 each year, Toys R Us would not be in this predicament.

Dated Store Displays

Not too long ago (perhaps early 00s), Toys R Us did away with the X aisle layout and converted them back into horizontal rows once again. However, the aisles now run left to right in-store rather than the original front to back design (which was arguably its best floor plan). Unfortunately, their fixtures are all incredibly dated pegboard and 70s style metal fixtures. They look like they’re straight out of a 70s store… even when the store is brand new. Maybe these are the cheapest fixtures they can buy? No idea, but they don’t look modern.

The store is also incredibly jam packed with stuff. The shelves are always full of stock yes, but it doesn’t help when the stock is old and is sitting on dated shelving units lit by 70s style fluorescent lighting fixtures.

The Business

Here’s Toys R Us’s primary operational problem and the problem that ultimately leads to where we are today. Toys R Us always relied on the holiday shopping season to pull its stores into the black. Meaning, Toys R Us always operated its stores in the RED through 80-90% of the year hoping for the holiday season to pull each store up and out and operate in the black for that year. This was the chain’s primary mistake. This operating model had been ongoing since the 80s. This was the way that TRU intentionally chose to operate its stores. This was also entirely their biggest operating failure and it’s the mistake that is now what’s threatening closure and costing TRU its business.

In addition to operating in the red, Toys R Us also didn’t wield its buying power to get the best possible credit terms, the best possible deals and the best possible return arrangements. If a toy doesn’t sell, package it up, send it to another store that can sell it or send it back to the manufacturer for full or partial credit. Let the manufacturer deal with that stock rather than trying to organically clearance out items on the shelves years later. No, get these old toys off of the shelves to make way for new toys. Fill the shelves with toys that can sell and that will pay the bills.

If you can’t pay your bills, you can’t stay in business. Business 101. Yet, Toys R Us management felt that they were above these rules. The management team felt they could continually run their stores in the red without ramifications. Well, fate has now caught up with you, Toys R Us.

Being Acquired by Private Equity Firms

Because of the way Toys R Us chose to operate its stores, it could not support being acquired in this way. This acquisition was entirely shortsighted on the part of the private equity companies involved and they (and us consumers) are the ones who are now paying the ultimate price.

In 2005, Toys R Us was acquired by a set of private equity firms. These firms included KKR & Co., Bain Capital and Vornado Realty Trust in a $7.5 billion buyout deal. These three companies (and their investors) sank $1.3 billion of their own funds into the purchase, leaving the rest of the purchase price of $6.2 billion to be made up in loans. These loans saddled Toys R Us with an over $6 billion debt burden. A debt that, because of the rather nonsensical business model that the stores had been following since the 80s, could never be recouped. All of this leads to…

Bankruptcy

In late September 2017, Toy R Us filed for bankruptcy protection against its creditors. This means that its creditors can no longer go after Toys R Us for not paying bills. It also meant that the loans left over from that terrible 2005 buyout deal could no longer collect on those loans. Of course, in return for this court issued bankruptcy protection, the company has chosen Chapter 11 to work through a plan to reorganize in a way to get themselves back to profitability and pay their creditors over time before time runs out. For the Toy R Us management, that meant finding a suitor to buy the business… because, of course, they couldn’t be bothered with actually trying to restructure the stores in a way to make them profitable. Oh, no no no.. that’s just too much work.

What? Are you kidding? Are you really expecting some well funded company to swoop into this ailing business holding onto a mountain of debt and offer to buy you? Really? The way that TRU operates is textbook operating procedure for failure. It cannot continue to operate in the way that it does. Even closing half of the stores may not be enough to solve this operating problem. It’s only surprising that it took this long for this toy chain to make it to this point. I expected this day to come a lot sooner.

Toy Collectors and Toys R Us

I full well expected to see Toys R Us fail in the 90s. However, Star Wars saw to it to keep Toys R Us in business. The Star Wars collectors came out in wild abandon to snap up tons of revamped Star Wars merchandise for not only the previous trilogy (including the Orange and Green carded Power of the Force series), but also snapping up the then new prequel trilogy toys. These toys still remained hot even after 1983’s Return of the Jedi cooled down. It all heated up again when the Prequels began in earnst in 1999 (toys beginning to appear in stores about a year earlier). Toys R Us got a reprieve from their red ledger problems due primarily to Star Wars collectors, Hasbro and a few other unrelated hot toys during the 90s (Tickle Me Elmo). Almost every year, there was some new fad that kept Toys R Us’s year end strategy in check. Though, this strategy would ultimately fail them when, in the last 10 years or so when there just haven’t been those must-have toys or collectible Star Wars toys. Even the Zhu-Zhu pets weren’t enough. Even the latest Star Wars trilogy from Disney has not had the merchandising power that the 90s saw. Though, Disney isn’t crying over what they have sold.

In fact, I’d venture to guess that the 90s collectors have all but stopped collecting and have moved on with their lives… which put a huge crimp in the Toys R Us budget. In fact, during the collector heyday of the 90s, Toys R Us did their very level best to chase away the collectors. Much to their own chagrin, they succeeded in doing so by the mid-2000s. It also doesn’t help that collectors can now buy full cases directly from places like Entertainment Earth, which no longer meant the need to scour the pegs at Toys R Us in the wee hours of the morning. You could order cases directly from the comfort of your own home, then see them delivered to your doorstep.

Amazon and Online Shopping

Because of the power of the Internet, Amazon and eBay, it’s pretty easy to find that hot toy at more reasonable prices. Yes, Toys R Us is still a staple in the current shopping landscape. When it closes, both Amazon and Entertainment Earth will simply pick up where Toy R Us left off without missing a beat. If anything, I’d suggest that Amazon pick up the Toys R Us branding at a fire sale during liquidation and rebrand the Amazon toy section to Toys R Us. Keep the TRU brand alive, but not with all of that bloated store baggage. Then, dump the Babies R Us brand entirely. You can still sell baby things, but branded as Toys R Us.

Toys R Us Closing

As I said, I have a love-hate relationship with Toys R Us. I do enjoy visiting and seeing what’s new, but every time I walk into a store, I’m confronted with the dated shelving and decoration, the continual nagging reminder of just how careless the management is and how much of a wasted opportunity that Toys R Us was when it could have become the biggest most profitable toy chain in the world. Yet, they’ve failed.

If Toys R Us can manage to pull a rabbit out of a hat at the last minute and keep the lights on, I’ll be fine with that. Sadly, I think this is likely where it will all end for Toys R Us.

Gift Cards or Rewards — Use em’ or lose ’em

If you have any remaining unused gift cards from Toys R Us, be sure to visit a store now and use them immediately. Don’t wait until after Toys R Us begins closing its stores.

If you have any remaining unused gift cards from Toys R Us, be sure to visit a store now and use them immediately. Don’t wait until after Toys R Us begins closing its stores.

Likewise, if you have any rewards points left on your rewards card, log into Toys R Us Rewards, issue certificates and use them up now. Same for Babies R Us Cashback Endless Rewards program. Otherwise, forfeit your chance to convert those points into dollars. Representatives for Toys R Us have said that they will honor gift cards, rewards points and cashback programs for 30 days. The 30 day clock likely began on Wednesday March 14th, when they filed their liquidation paperwork with the court.

I guess in an odd way, I do kind of get that shopping spree after all, and many years later. I just found that I have over 2500 points in my rewards account. That equates to a $100 shopping spree.

For my $100 in rewards points, I got a Nintendo Monopoly set, a Care Bear Grumpy Bear, Two Schliech Geoffrey branded figurines, 5 different Halo Hot Wheels, a Pit Amiibo, a Pain-Yatta Skylander, a Playmation Vision figure and two Geoffrey branded reusable shopping bags. I ended up paying $9 to cover the tax. I also bought a $5 Geoffrey gift card and immediately used it to get dock protector straps for a Nintendo Switch. I wanted the Geoffrey branded gift card as a souvenir. I’d also previously purchased the day before, two Geoffrey 18″ plush and one Geoffrey plush gift card holder, which I’ll put that used Geoffrey gift card in.

Returns and Exchanges During Liquidation

Check any purchased merchandise thoroughly for defects the same day you buy it. If there are any problems, return it the same or next day and exchange it. Don’t wait even a few days to exchange as you may not be able to find the same item. According to Toys R Us representatives, all sales are final. This means, no refunds. However, they may continue to honor exchanges for a period of time. If you’re uncertain of any of this, ask for details at the service desk before you buy.

If you’re thinking of shopping for gift items, you might want to buy elsewhere. Buying a gift for someone could mean the gift recipient can’t return or exchange the item. You don’t want to force a gift onto someone when it’s not something they want only for them to find they cannot return it.

Be that Toys R Us Kid one last time

If you grew up visiting and are as fond of Toys R Us as I am, I’d suggest for you to take a few minutes out of your day and visit your local Toys R Us to reminisce about the good ole days. Once the liquidation sales start, they’re quickly going to look like half-filled shells of a store. Note that the deadline for Toys R Us to find a buyer is early April of 2018, so visit them quick. You have less than a month.

You might even want to pick up a souvenir, such as a plush Geoffrey, to remember what was Toys R Us and what it meant to us as kids. If you want a plush Geoffrey, ask at the Customer Service desk. It seems they keep them there for some reason.

Film Review: The Warning – PBS / Frontline Documentary

Rated: 4/5 stars.

PBS’ The Warning Documentary

The Warning is a PBS documentary discussing a warning from Brooksley Born, an attorney and a former Commodity Futures Trading Commission (CFTC) chairperson. She explained that derivatives were extremely risky insurance vehicles and sent a warning that these vehicles needed regulation during her tenure as CFTC chairperson, but her warnings went unheeded. She resigned in 1999 from the CFTC position after legislation was passed preventing her agency from regulating derivatives.

Vision of this Documentary

While I would like to rate The Warning higher, its take is pretty much tunnel vision on the derivatives markets. While the derivatives markets did melt down and did, to a large degree, spur the meltdown onward, the meltdown was not started because of derivatives. The derivative meltdown was a casualty of and was exacerbated by the sub-prime mortgage meltdown. Had the mortgage industry bubble not burst, the derivatives market might have gone unchecked for many more years. The warning was and should have been about placing regulations onto mortgage lending practices. The mortgage lending industry is the industry that failed and sent the economy into a tailspin, let’s make that perfectly clear. The derivatives (insurance) market, which speculated on the mortgage industry, single-handedly sent Wall Street into a tailspin (along with several large insurance companies like AIG).

Derivatives and the Mortgage Meltdown

Anyone with half a brain in their head could see that using questionable lending vehicles like interest only loans for the first two years or adjustable rate mortgages were ticking time bombs. When the actual monthly payments came due years later after rates went up to where they should have been, people couldn’t afford pay. This was especially true when lenders were handing these loans to people who could barely afford the ‘introductory period’ payments. So, loans came due, people defaulted and the rest is history. The derivatives (insurance policies) that were issued also came due because of the en masse foreclosures. Insurance companies that issued derivative policies speculating people wouldn’t default en masse began to fail because their speculation was wrong. So then, these insurance companies couldn’t pay off on the insurance claims. So, when consumers defaulted, so did the insurance companies offering derivatives.

It wasn’t as if warnings weren’t being issued regarding the inevitable mortgage meltdown, it’s just that Brooksley Born (the focus of this film) was not one of the people issuing the mortgage warning. Her warning was strictly about the highly risky derivatives. More specifically, the black box non-transparent nature of them. The danger, of course, is that derivatives can be placed on any speculative and risky investment as insurance. The reason derivatives need to be regulated is to prevent companies the size of AIG from making stupid decisions about such risky vehicles. However, from a consumer perspective, banks should never have gotten into the position of issuing such risky mortgages like water to people who couldn’t afford them. This was the single mistake that led to where we are today and that mistake has nothing to do with derivatives and everything to do with Government and the Federal Reserve making stupid decisions.

Overall, the movie is worth watching, but also understand its information’s place in the larger meltdown that was at work in our economy.

Business Organization Fail: The failure of the sales pipeline

In my line of business, purchasing services is part of doing business. Unfortunately, many businesses fail at sufficiently managing this budding relationship properly. This time is a crucial in relationship building between the two companies. If the order process does not go smoothly, is delayed or is slow to process or complete, this can damage the relationship from the start. A lot of companies pride themselves on their actual services, but how many company’s pride themselves or tout their order entry and completion processes? Not many.

All too often, you place an order for a service and the order does not complete as you expect. At first, you think this operation should be simple. However, when installation day and time passes without a peep, this leaves you wondering what happened. So, you call the sales and/or customer support line only to find out they don’t have a record of your order. Unfortunately, this is a sign of disorganization. A sign that this company fails to manage the order entry and order pipeline system properly. This is a company that should leave you with the question, “Do I really want to do business with them?” Rightly, you should be asking yourself that question. In some cases, however, this may be a cable company or some other company where you are over a barrel. Defacto monopolies exist in society and there’s little we as consumers can do about that. So, if you want that service, you must purchase it from that company or you don’t get it. But, even with all of that in mind, you should still ask the question, “Should I do business with this company?”

Disorganization is nearly always a sign of things to come. If there is this much disorganization surrounding the installation and the order process, that does leak into other parts of the business including the actual service itself. So, you may find your service affected in random ways throughout the life of the service. These problems may include, unintentional service disconnection, incorrect billing and invoicing including double billing and inaccurate billing to sporadic service quality and uninformed service outages and even installation issues resurfacing months or years later. Disorganization affects far too many businesses. Worse, most businesses don’t even recognize that they are affected, let alone do anything about it. Bigger businesses are more prone to disorganization than smaller companies, but business of all sizes can and are affected. With large companies, the departments and staff get more and more disconnected. As the departments get bigger and more disconnected, employees adopt a ‘not my job’ mentality and once something reaches the limit of their job description, they push it off their desk with no thought to the customer’s relationship. Once it’s pushed off their desk, they don’t really care what happens. This can leave holes that let customers’ orders fall through the crack and not be serviced.

With small businesses, disorganization happens from immature processes and/or constantly shifting priorities. Also with small businesses, these companies are usually understaffed and that leaves the employees overworked. So, instead of the service order falling into a black hole like a larger company, the order simply gets buried on the desk (or in email). This results in lack of order tracking. Effectively, big or small company, the problem is the same: a lost order.

Organizing: Documentation and Communication

Order taking doesn’t have to be a complex process. It does, however, need a process. In large companies, each department needs to be on the same page. So, that means sales, billing, customer support and technical support all need to use the same system to reference order numbers. Having multiple order tracking systems is ripe for failure in the order process. There’s nothing worse than need three or four reference numbers to discuss an order. Worse, though, is when you call and they can’t even look up any of the order numbers and they resort to company names, service addresses and phone numbers. Sometimes these don’t even work. When nothing works to look up your account, that indicates either an incompetent service representative or fractured systems. If you get a service rep who can’t seem to find your order, ask them for their name, thank them and call back. When you get a new representative ask them to look up your order or company. If they immediately find it, you should report the previous representative to their supervisor. Representatives can sometimes intentionally prevent finding the company to get you off the phone faster. These need to be reported.

Companies must recognize disorganization in order to fix it. Without recognizing this issue, the company cannot change their internal processes. The processes must be streamlined from start to finish. This is why many businesses adopt and use ISO 9000 standards certifications. These certifications, while rigorous and somewhat costly to obtain and somewhat costly and rigorous to maintain, ensure a high quality customer experience from start to finish. These certifications require that every department follow a blueprint each time they interact with customers. A set of steps that always lead the customer through the same experience. It sets quality standards from services and products and, again, it overall ensures a high quality customer experience.

Many larger companies require ISO certifications of their vendors. This certification process ensures there is a commitment of quality and a level of organization associated with a company’s service offerings. In other words, ISO certification immediately tells would-be buyers that they can expect a certain level of quality. ISO certifications require each employee to write their processes down of how to properly work through their daily jobs. Once these processes are documented, it’s easy to hand the documentation to new staff and have them follow these standards. Standards set by a company ensures that products and services are efficiently provided. Without any standards in place, this quickly leads to disorganization and haphazard and random methodologies in placing and managing the order process. Without standards and processes in place, a company cannot provide high quality services as easily or consistently.

Communication with prospects is key to an order’s success. If there is an issue with an order, there needs to be someone in the organization to manage these delays. Someone should be tasked with keeping track of orders and managing (by contacting the customer) when there is to be a delay or an unexpected issue that may prevent an order from completing properly. So, on top of the processes in place to make sure orders always take the same path, there needs to be a person to manage the order fully from start to finish. Additionally, systems need to be interlinked properly so that Sales, Customer Service and Billing can be on the same page at the same time. There is nothing worse than calling in and asking about the progress of an order only to find out the order was cancelled from lack of communication.

What’s wrong with Vista / Windows?

This post comes from a variety of issues that I’ve had with Vista (specifically Vista 64 Home Premium). And, chances are, these problems will not be resolved in Windows 7. Yet, here they are in all their glory.

Memory Leaks

Vista has huge and horrible memory leaks. After using Vista for a period of time (a week or two without a reboot) and using a variety of memory intensive 3D applications (Daz Studio, Carrara, The Gimp and Poser.. just to name a few), the system’s memory usage goes from 1.69GB to nearly 3GB in usage. To answer the burning question… yes, I have killed all apps completely and I am comparing empty system to empty system. Worse, there is no way to recover this memory short of rebooting. If you had ever wondered why you need to reboot Windows so often, this is the exact reason. For this reason alone, this is why Windows is not considered ‘stable’ by any stretch and why UNIX outperforms Windows for this reason alone.

Startup and Shutdown

Microsoft plays games with both of these procedures.

On Startup, Microsoft’s engineers have tricked you into thinking the system is functional even when it isn’t. Basically, once the desktop appears, you think you can begin working. In reality, even once the desktop appears, you still cannot work. The system is still in the process of starting up the Windowing interface on top of about 100 background services (on many of which the windowing interface relies). This trick makes Windows appear snappier to start up than it really is. In fact, I would prefer it to just ready the system fully, then present the Windowing interface when everything is 100% complete. I don’t want these tricks. When I see the windowing interface, I want to know I can begin using it immediately… not before.

On Shutdown, we have other issues. With Vista, Microsoft Engineers have done something to this process to make it, at times, ridiculously slow. I have seen 8-15 minute ‘Shutting Down’ screens where the hard drive grinds the entire time. I’m sorry, but shutdown time is not housekeeping time. That needs to be done when the system is running. It should not be done during shutdown procedures. A shutdown should take no more than about 1-2 minutes to complete flushing buffers to disk and killing all processes. If it can’t be done in 1-2 minutes, shut the system down anyway as there is nothing that can be done to finish those tasks anyway.

Windows Updates

Microsoft was supposed to eliminate the need to shutdown/reboot for most Windows updates. For some updates, this is true. For the majority of Windows updates, this is still not true. In fact, Microsoft has, once again, made this process multistep and tediously slow in the process. Don’t get me wrong, I’m grateful that they are now at least verbose in, sort of, what’s going on.. but that doesn’t negate the fact that it’s horribly slow. The steps now are as follows:

- Windows installation process (downloading and installation through the Windows dialog box). You think it’s over when you..

- Restart the system and it goes through finishing Step 2 of this process during shutdown… and then you think it’s over again when

- The system starts back up and goes through Step 3 of the update process.

Ok, I’m at a loss. With Windows XP, we had two steps. Those first during Windows updater and the second when the system starts back up. Now with Vista, we have to introduce another step?

Windows Explorer

For whatever reason, Windows Explorer in Vista is horribly broken. In Window XP, you used to be able to configure your Windows how you liked then lock it in with Tools->Folder Options and then View->Apply to Folders. This would lock in exactly how every window should appear (list or icon format, size of icons, etc). With Windows Vista, this is completely and utterly broken. Basically, this functionality simply no longer works. I’ve tried many many times to lock in a format and Windows just randomly changes the folders back to whatever it feels like doing.

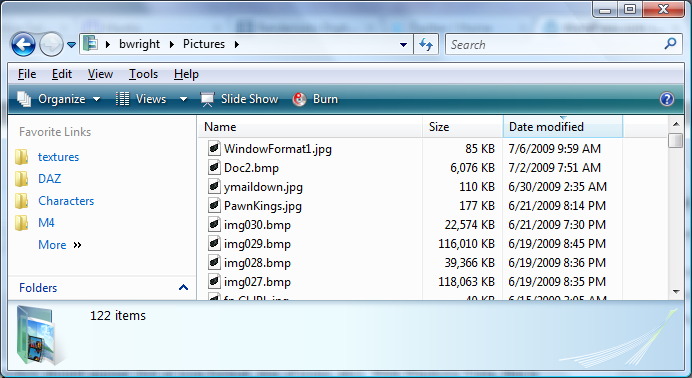

For example, I like my windows to look like this:

Favorite Format

Unfortunately, Windows has its own agenda. If I open a file requester (the standard Vista requester… the one that looks like the above) and I change the view to ANY other style than the one above, this change randomly changes other folder views on the system permanently. So, I might open the above folder and it will later look like any of these:

Format Changed 1

Format Changed 2

or even

Format Changed 3

All of which is highly frustrating. So, I’ll visit this folder later and see the entire headers have changed, or it’s changed to icon format or some other random format. Worse, though, is that I’ve specifically changed to the folder to be my favorite format with Tools->Options. In fact, I’ve gone through this permanent change at least 3-4 times after random changes have happened and inevitably it changes to some other format later. Again, highly frustrating.

Access Denied / Enhanced Security

For whatever reason, Microsoft has made shortcuts to certain folders. Like for example, in your profile directory they have renamed ‘My Documents’ to simply ‘Documents’. Yet, for whatever reason, Microsoft has created shortcuts that don’t work. For example, if I click on ‘My Documents’ shortcut, I see ‘Access Denied’. I don’t get why they would create a shortcut and then prevent it from working.

The only thing the enhanced security has done for Windows users is make it more of a problem to work. Security goes both ways. It helps protect you from malicious intent, but it can also get in the way of usability. Security that ultimately gets in the way, like UAC, has failed to provide adequate security. In fact, it has gone too far. UAC is a complete and utter failure. Combining this with making nearly every security issue tied to the SYSTEM user (with practically zero privileges), makes for stupid and exasperating usability.

Filesystem

To date, Windows still relies heavily and ONLY on NTFS. Linux has about 5-6 different filesystems to choose from (Reiser, VxFS, XFS, Ext2, Ext3, JFS, BSD and several others). This allows systems administrators to build an operating system that functions for the application need. For example, some filesystems perform better for database use than others. On Windows, you’re stuck with NTFS. Not only is NTFS non-standard and proprietary (written by Veritas), it also doesn’t perform as well as it should under all conditions. For database use, this filesystem is only barely acceptable. It has hidden limits that Microsoft doesn’t publish that will ultimately bite you. Microsoft wants this to become a pre-eminent datacenter system, but that’s a laugh. You can’t trust NTFS enough for that. There are way too many hidden problems in NTFS. For example, if you hit a random limit, it can easily and swiftly corrupt NTFS’ MFT table (directory table). Once the MFT table is corrupt, there’s no easy way to repair it other than CHKDSK. Note that CHKDSK is the ONLY tool that can truly and completely fix NTFS issues. And, even CHKDSK doesn’t always work. Yes, there are third party tools from Veritas and other companies, but these aren’t necessarily any better than CHKDSK. Basically, if CHKDSK can’t fix your volume, you have to format and restore.

Note, however, that this isn’t a general Vista issue. This problem has persisted back to the introduction of NTFS in Windows NT. But, Microsoft has made no strides to allow or offer better more complete filesystems with better repair tools. For example, Reiser and EXT3 both offer more complete repair tools than NTFS ever has.

Registry

The registry has got to be one of the most extensive hacks ever placed into any operating system. This kludge of a database system is so completely botched from a design perspective, that there’s really nothing to say. Basically, this system needs to be tossed and redesigned. In fact, Microsoft has a real database system in MSSQL. There is no reason why the registry is not based on MSSQL rather than that stupid hack of a thing call a hive/SAM. Whomever decided on this design, well.. let’s just hope they no longer work at Microsoft.

Failure

For the above reasons (and others), Microsoft has completely failed with Windows Vista. This failure was already in the making, though, when Longhorn was announced ages ago. In fact, Microsoft had planned even more draconian measures to enable heavy DRM on Windows. Thankfully, that was removed from Vista. But, what remains makes Vista so encumbered and exasperating to use, it’s no wonder users are frustrated using Vista. Combining that with its incredibly large footprint (1.6GB of memory just to boot the OS), and you have a complete loser of an OS.

Windows 7 is a glimmer of hope, but it is still heavily tied to Vista. If UAC and these stupid SYSTEM user security measures remain, then nothing will really change. Microsoft needs to take Windows back to the drawing board and decide what is necessary and what isn’t. Preventing the user from actually using the operating system is not and should not be a core value, let alone part of security. Yet, here we are.

Microsoft, you need to take a look at the bigger picture. This is your final chance to get Windows right. There are plenty of other unencumbered operating systems out there that do not get in the way of desktop computing. These operating systems are definitely a threat to Microsoft’s continued viability… especially with blundering mistakes like Vista. Windows will never win any awards for Best Operating System with issues such as these. Consider Microsoft’s stupid filesystem layout that allows operating system and application files to be thrown all over the hard drive and you’ll begin to understand why Windows continues to fail.

The single reason why Microsoft continues to exist is because users feel compelled to buy this antiquated dog of an operating system strictly due to application support. If developers would finally and completely jump ship to other more thoughtfully designed operating systems, then Windows would finally wither and die… eventually, this will happen.

Bush approves $17.4 billion for auto makers

While this may come as no surprise to anyone, we really have to wonder if these bailouts are in the best interest of the US. Yes, yes, I understand the argument about people losing their jobs, the trickle down issue of suppliers going out of business, etc etc. I do understand all of that. But, the one significant question is… When did it become the government’s responsibility to make sure businesses remain in business? Isn’t that the business’s responsibility?

Credit Crisis

Clearly, every company that has to extend credit is at risk during the credit meltdown, but the Detroit car makers were in trouble long before the credit meltdown. It’s just that now it is making it even harder for them to sell cars. But, is this because of the credit meltdown or is it the types of cars they are producing?

While I would love to say that their woes can be entirely blamed on the credit crisis, it can’t. Detroit has been lagging behind producing unappealing cars for many years now. Is it no wonder no one is going to the dealership and buying their cars? Sure, consumers may not be able to get the credit necessary to get a new car now, but even when credit was readily available, consumers still weren’t buying. If Detroit were making cars that people want, their business would have been booming all along. Just look at Apple. They make appealing technological products. Even in this economy, people are still buying iPhones that come with $90-120 a month plans! It’s an amazing feat when people, who probably cannot afford that amount per month, are shelling out that money just to get an iPhone!

Yet, the car makers can’t get their cars into consumer’s hands. So, the big question is.. why? Clearly, they aren’t providing high enough quality or appealing enough design, nor are they doing anything about becoming ecologically friendly. When gas prices hit almost $4 a gallon, they were still cranking out cars producing 20 mpg. Does this make sense?

By Design

The Detroit design teams need to rethink their ideas. They need to come out with some innovative approaches to vehicles. That means, trying things that haven’t been done before. I don’t usually like to give out free ideas, but I’ll make an exception here. For example, Toyota put into the Prius a touch screen control panel for pretty much all of the necessary comfort and convenience systems of the car. That’s a great first step. But, let’s take that one step further. Auto makers need to put in a touch screen system to control all aspects of the car including such things as controlling and viewing the engine tuning, tire pressure, and setting and releasing cruise control.

They should probably team up with Apple (or Microsoft) to add a mainstream operating system (embedded, of course) into their cars. Cars should offer WiFi or 3G connectivity. Cars should also have a full fledge computer as an optional built-in. But, the computer needs to be removable to take in during excessive heat or cold.

Ecologically Friendly

Fuel cells have been talked about for quite some time. But, this and other forms of innovation has not progressed. For example, when you’re driving the car along, there are other ways to recoup energy into the batteries. For example, wind and sun. As you’re driving, there is wind against the car. It should be a simple matter to add a wind turbine to recoup energy during driving. Adding solar panels in strategic places would also allow for additional energy.

Frankly, I’m surprised someone hasn’t come up with a photo conductive paint surface to use the entire vehicle’s painted surface as a giant solar panel. These are the kinds of innovations that make you go, “Hmm”. These are also the kinds of innovations that lead energy conscious consumers to buy into them. Regenerative breaking is a great first step, but we need to take it far beyond that.

Business 101

The detroit car makers have become so distant from what people actually want, that they can’t consistently produce sellable products. When you’re putting a car together, which is not an insignificant task, you want to make sure that you produce the best product possible. Detroit seems to have lost that edge and, instead, is hiding in a cave producing things they feel are ‘safe’, but that don’t sell.

Government and Business

What it comes down to is that Government should not become (nor have to become) involved in the day to day operations of ANY business, let alone the car makers. So, if these companies can’t produce quality wanted products, perhaps it’s time we let them go. We don’t need to prop up industries that don’t deserve to be propped up… no matter how many employees or small companies that they may incidentally subsidize.

Car Maker Bailout

Because I’ve already discussed my views on bailouts, I’ve debated about creating a post on this topic. So, I will keep this one short and sweet.

No no no! No bailout for car makers. We do not need to be footing any more bills for badly run companies. If the car makers cannot get their act together on their own, what makes anyone think they’ll be able to succeed with an infusion of cash from the government? The answer, they won’t.

Worse, without any government oversight (and there has been little oversight of the bank bailouts), they’ll take the cash and run without actually becoming accountable for it.

Again, no no no. No more bailouts. Let these companies go through Chapter 11 and rework their own company’s finances on their own.

Does CitiGroup deserve a government umbrella?

I guess the broader question, does any large commercial business deserve to be bailed out? Well, clearly Mom and Pop businesses fail every day. Yet, the government does nothing. Why do large conglomerates deserve special treatment?

The short answer is that there is some magical threshold where there are too many people who would lose their jobs as a result of the failure combined with possible economic ramifications. But, still, does that warrant a bailout? No.

If a business cannot run itself in a fiscally appropriate manner (large or small) it deserves to fail and go away. If any of your family is employed by CitiGroup or any financial company caught up in the turmoil of the financial sector crisis, I feel for you. But, that doesn’t mean that the company deserves to continue to exist if they cannot maintain profitability even in the toughest of times. Fiscal responsibility starts at the top of the company and trickles down to even the most bottom level employee.

What does this mean? It means, don’t request a new computer every year. Don’t ask for Herman Miller chairs and the most expensive ergonomic keyboard simply because you can. If the item is considered ergonomic, the company is almost obligated to make sure you get it. Buying all of these expensive amenities for your desk makes you fiscally irresponsible to the company if you don’t really need it (and, in most cases, you don’t). But, that’s not to say that this is responsible for CitiGroup’s problems.

Who knows where the money hemmorage is going inside these companies. But, clearly, it’s not going back into the business. Again, I ask, why do these companies deserved to be bailed out? What makes them special? I have no sympathy for large companies that can’t properly manage themselves. Neither should the government. Spending all of this money to prop up these badly run organizations is clearly counter to free enterprise.

In Free Enterprise you have to take the good with the bad. That means, when business is good, you profit. When it’s bad, you bankrupt and close. There needs to be no governmental cushion here to soften the fall.

Does CitiGroup or any other badly run business deserve an umbrella? What do you think?

State of the economy

Unless you’ve been hiding in a cave, you’re probably well aware of the issues facing the banking and finance sectors of the economy. Here are my thoughts on this.

What started it all?

Clearly, this whole debacle started when the feds lowered the interest rate to 1% and the mortgage firms saw a field day. One only had to listen to the radio for about 5 minutes to hear a commercial for some bank advertising stupendous mortgage rates. During this period, this became known as the housing bubble. This sector was primarily propping up the economy even when consumer spending in other areas was lackluster.

Government regulation (or lack thereof)

First, this whole debacle would not have become an issue if the government had been properly regulating the banking industry. Unfortunately, this presidential administration has been so pro-business that they would let anything and everything slide to let businesses do whatever they want. Is government to blame? Yes, but only partly. The rest of the blame falls squarely on the businesses.

Does AIG and Lehman Brother’s deserve to fail? Most certainly they do. Badly run companies need to go away. If a company can’t do the proper things to ensure continued success, then they deserve to fail. Unfortunately, the government and the stock market don’t see it that way. Because AIG and Lehman propped up much of the banking industry with their services, letting these businesses fail is tantamount to pulling the rug out from under you while you’re walking. The issue here is… putting all your eggs in one basket. Drop the basket and.. you get the idea. Government LET banks basically put their eggs into one basket by allowing bank sector consolidations (this goes back to letting businesses do whatever they want to do). Instead of raising an issue when it should have been raised, the government just sat there and said nothing. So, instead of saying.. no, there must be several insurers to prevent ‘eggs in one basket’, the banks’ insurance policies were not policed and were primarily underwritten by AIG.

Lending Practices

The banks, brokers and mortgage firms are clearly to blame for beginning this debacle. If they had been practicing proper loan practices, this issue would not have occurred. Instead, they were not only handing out loans to anyone and everyone, they were handing out risky loans. Loans such as interest-only loans for the first two years or adjustable rate mortgages (ARMs) that would also reset in 2 years.

Then, we had the speculators buying two, three, four or more homes all with multiple loans given by these ever-so-gracious banks. It’s not as if the handwriting wasn’t on the wall. But, again, no one stepped in to put on the brakes.

So, the foreclosures started, homes got devalued, more foreclosures ensued, banks began losing their interest payments and gaining properties they couldn’t sell… Banks tried to collect on their insurance policies for a bad loan from AIG. The payouts forced it to bubbled up to the top feeders who’s bottom lines got severely hit (like AIG and Lehman). Then, bankruptcy…

Bailout

So, that’s all hindsight.. what do we do now? The primary issue at this point is the bailout. Should it be allowed? Clearly, congress didn’t think so in the form that it was submitted. Personally, I’m torn. As a taxpayer, I don’t want to be forced to help bail out a company that isn’t run properly. If a company chooses to use policy holder premiums to buy executives parties, cars, yachts, summer and winter homes, vacations and everything else that can be thought of instead of banking that money in the case of insurance payout or to help fund rough times. then they need to go away.

On the other hand, I don’t really want the economy to go into the toilet. However, I think this issue is inevitable. The bailout is simply a bandaid. If the bailout does anything, it will just delay the economic issues until a few years out. Perhaps the bailout will smooth it out a little more than without it, but I don’t see the economy getting tremendously better with a bailout than without.

Tip of the iceberg

Worse, we are only seeing the tippy top of the iceberg. There’s way much more under water than we can’t see. How many other banks or financial institutions will fail before it’s all said and done? This is still unclear. There is also a trickledown here that just hasn’t completely trickled down yet. For example, local cities and municipalities will feel the crunch come property tax time. Now that so many homes are in foreclosure, the tax base is probably 75% of what it was… perhaps even less. Banks won’t pay the taxes on properties and the former owners won’t either. So, come 2009, and these municipalities will be struggling for budgets. This leaves police, fire and even education in the lurch again… and we haven’t even gotten there yet.

Stimulus Package given back

Since Bush has taken office, he’s given out two stimulus packages of around $500 each. That’s a total of $1000 to each person. However, if we are forced to bail out AIG, all of that stimulus will be wiped out and we, the taxpayer, will be forced to double that again (around $2-4k per person) to cover the bailout. We’re just going to give our stimulus package right back to the government and then also hand over additional cash.

So, where from here? The path is definitely not clear. But, the US certainly needs dramatic help both in government and in corporate businesses. How that’s supposed to happen, again, is not clear. But, we are certainly not on the path to success with skyrocketing deficit combined with financial debacles such as this. One thing is crystal clear, government needs to regulate corporations that cannot regulate themselves… and they need to regulate them BEFORE the issues become debacles.

leave a comment